nevada estate and inheritance tax

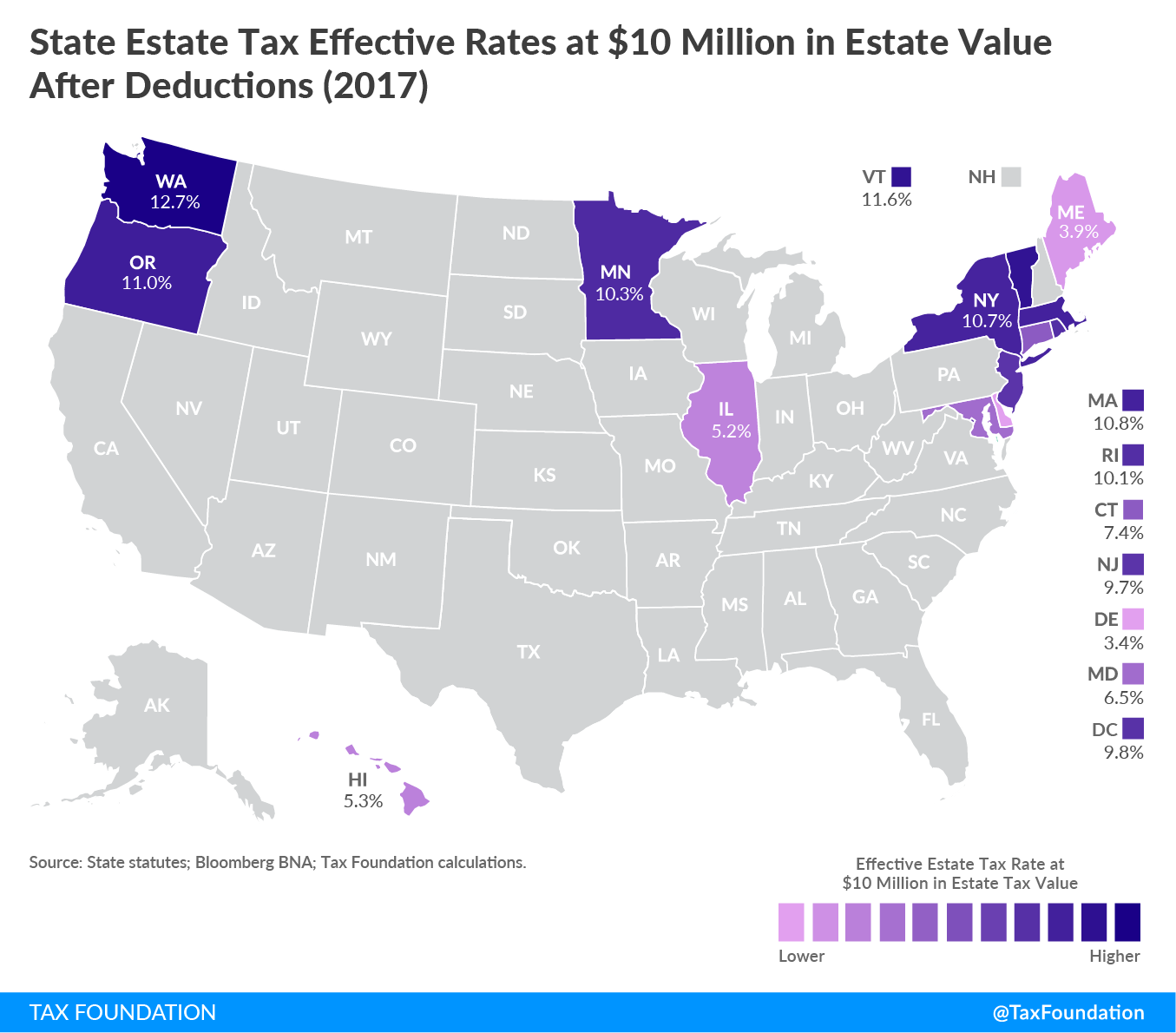

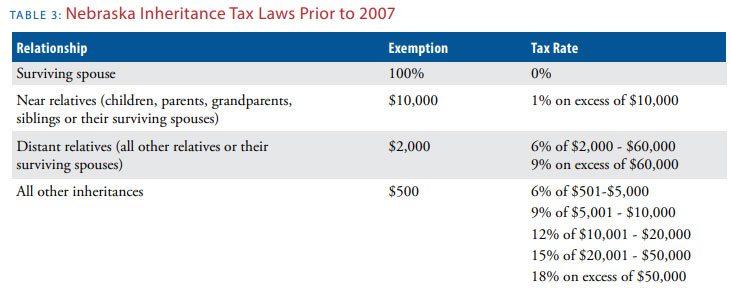

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is.

Nevada Probate Laws Inheritance Advance Options

The estate tax rate was adjusted so that the first dollars are taxed at a 9.

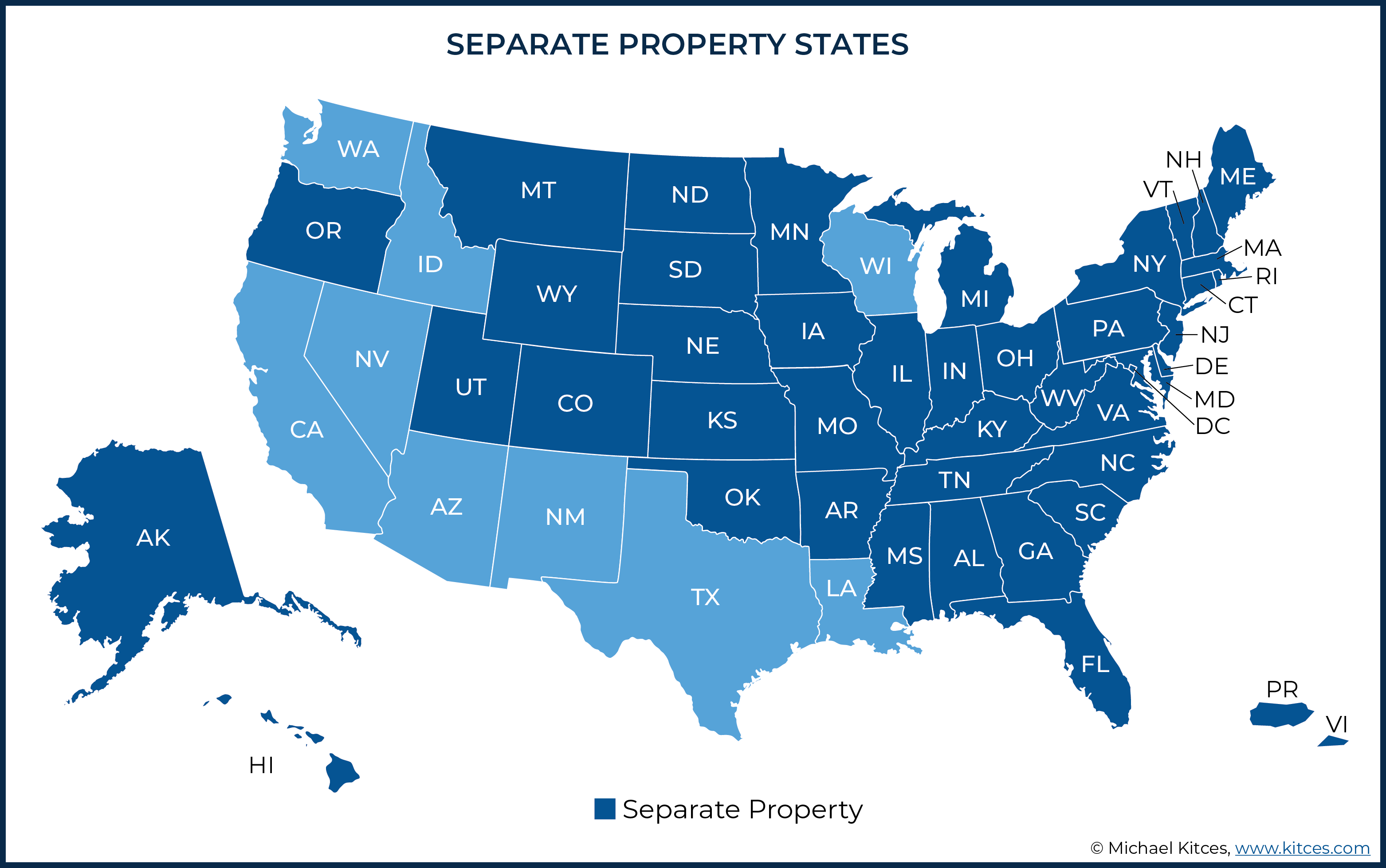

. If you are the one receiving the inheritance then youre responsible for paying any. There are no estate or inheritance taxes in the state either. A second key differentiation between estate and inheritance tax is who is responsible for paying the tax.

However an estate in Nevada is still subject to federal inheritance tax. Does Nevada Have an Inheritance Tax or Estate Tax. NV does not have state inheritance tax.

Federal credit means the maximum amount of the credit against the federal estate tax for state death taxes allowed by. No Estate Tax Laws in Nevada. Use e-Signature Secure Your Files.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. When it comes to estate tax there is a federal. No estate tax or inheritance tax.

The probate process is not required in Nevada if the decedent has set up a trust or family trust. To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on. Try it for Free Now.

Upload Modify or Create Forms. Estate taxes are levied on the total value of a decedents property and must. No estate tax or inheritance tax.

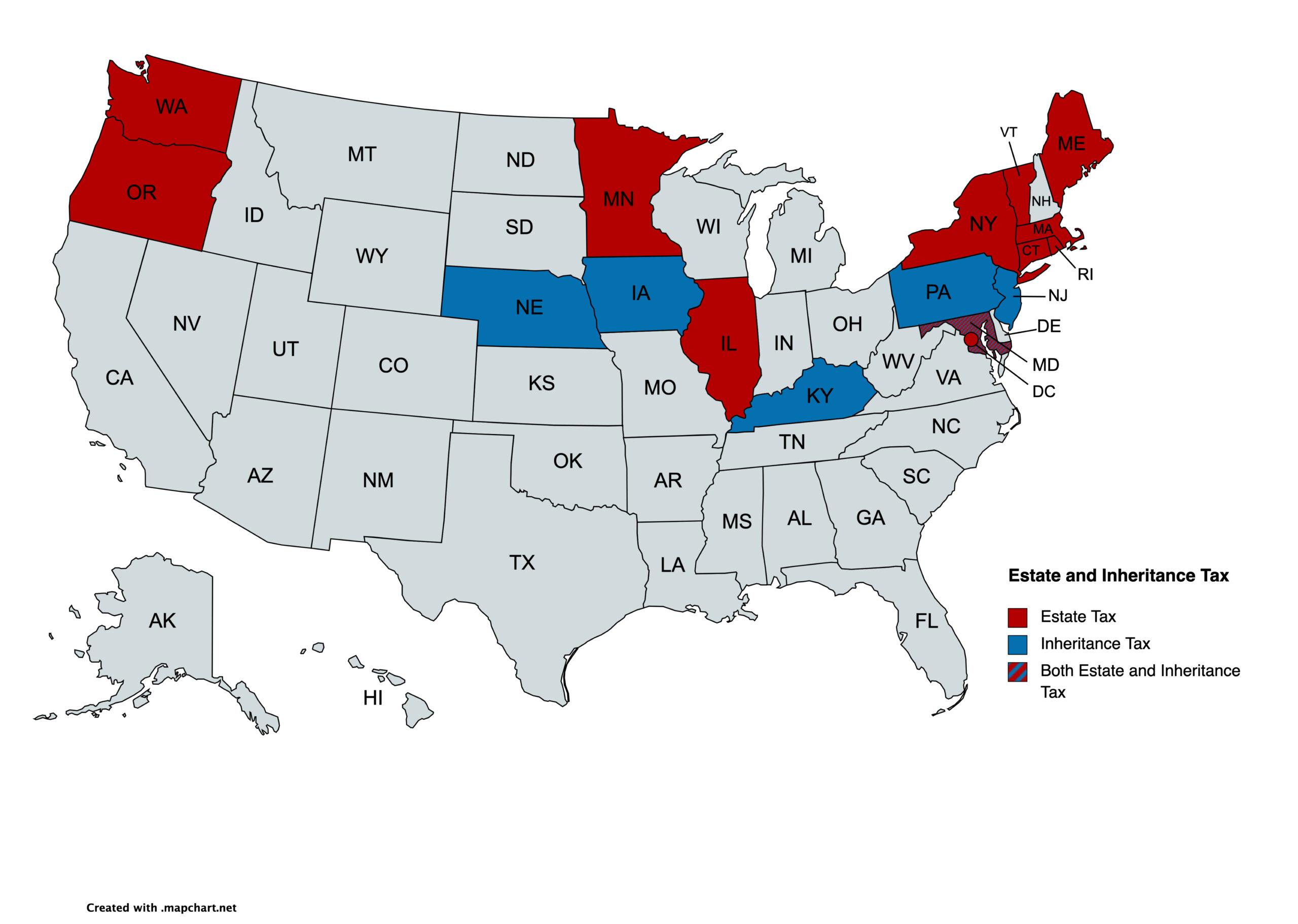

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Marylandwhich also has an estate taximposes the lowest top rate at 10 percent. Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate.

Inheritance taxes are remitted by the. The difference between inheritance and estate tax is a matter of who is responsible for paying the tax. Ad Register and Subscribe Now to work on NV 15-Days Notice of Intent to Lien more forms.

In 2021 the first 117mil per individual is exempt at the federal level. No estate tax or inheritance tax. The state of Nevada does not collect inheritance tax however federal taxation may also affect an inherited property even in Nevada.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

What Is The Difference Between Inheritance Tax Estate Tax

2490 Manzanita Ln Reno Nv 89509 For Sale Mls 220009531 Re Max

State Estate And Inheritance Taxes Itep

Estate Tax Planning In Nevada Stone Law Offices Ltd

Nevada Health Legal And End Of Life Resources Everplans

State Estate And Inheritance Taxes Itep

Death And Taxes Nebraska S Inheritance Tax

Here Are The States With No Estate Or Inheritance Taxes Gobankingrates

Inheritance Nevada Estate Planning And Probate

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

The Property Tax Inheritance Exclusion

Nevada Inheritance Laws What You Should Know

State By State Comparison Where Should You Retire

Nevada Estate Tax How 99 Of Residents Can Avoid

Estate Tax Planning In Nevada Stone Law Offices Ltd